Banking, like many aspects of life today, can seem complex. However, as a Bank created 173 years ago to make life easier for our neighbors, we strive to keep it as simple as our You Matter More promise.

To fulfill that promise to our employees, customers, and communities, in good and uncertain times, we have to deliver more.

We need to be more than a bank:

a trusted business partner;

a catalyst for innovation;

an expert and engaged team;

a community builder;

an industry leader.

Focusing on our fundamental promise ensures we are always ready with the caring, personal service, and exceptional products and services that Northern New Englanders have come to expect from us.

Today, local relationships matter more than ever.

Customers are counting on us to be...

more than a bank.

“As a community bank, it’s about relationships, trust, and stability. For over 173 years, we have been more than a bank for our neighbors in Northern New England. Our promise, ‘You Matter More,’ reflects our dedication to fostering trusted partnerships and building stronger, vibrant communities. Today, local connections are more important than ever, and our steadfast commitment ensures our customers receive the support they need.”

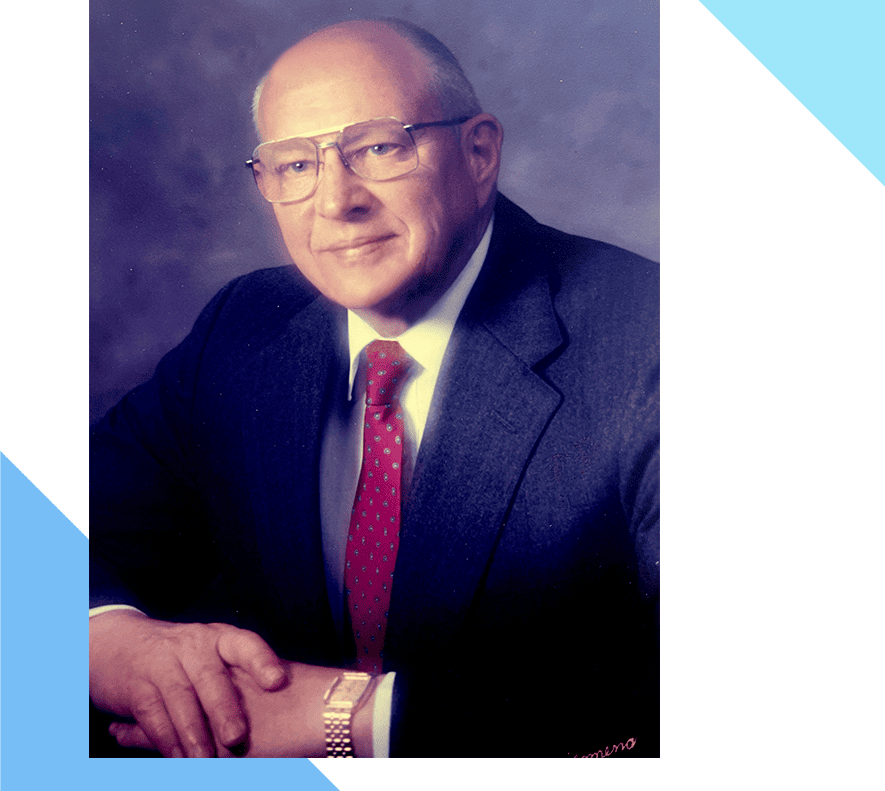

Bob Montgomery-Rice,

President & Chief Executive Officer

Letter from the President & CEO and Chair of the Board

To those we work with, our advocates, supporters, customers, and neighbors, we thank you —our success reflects the quality of the relationships that make us more than a bank.

Recognition & Awards

Our commitment to our employees, customers, and communities is reflected in the numerous recognitions we have received this past year.

Our Commitment to Financial Wellness

This past year, we continued to focus efforts that encourage financial wellness for our employees, customers, and communities.

Personal Banking

This year, we continued to assist individuals in buying homes, realizing their dreams, strengthening their communities, and enhancing their quality of life.

Business Banking

Our experienced team provides comprehensive financial solutions to help businesses grow, compete, and embark on new opportunities with confidence.

Community Investment

This past year, Bangor Savings Bank and its Foundation continued its dedication to strengthening communities across Northern New England through more than $3.6 million in sponsorships, grants, and charitable donations.

Financial Performance & Growth

Read our financials, our consolidated financial report, and an overview of our growth.

Corporate Structure, Governance, & Leadership | Bangor Bancorp, MHC

View all the members of our Board, Leadership Committee, and more.

Locations

Visit any of our 70 branches across Maine and New Hampshire.

Annual Report Book

Experience our Annual Report book in PDF format.

In Memoriam: G. Clifton Eames

April 14, 1927 - March 13, 2025

Farewell to a longtime Trustee and former Chair of the Board

Passing just shy of his 98th birthday, Clifton Eames was a true force for community and a man who embodied the ideal of doing more for others.

Clif retired from N.H. Bragg & Sons, the company started by his great-great-great grandfather in 1854, only two years after the founding of Bangor Savings Bank. Serving on the Bank’s Board of Trustees from 1976-1999, with the last 10 years as Chair of the Board, Clif’s tenure saw the Bank achieve numerous milestones, including the acquisition of 28 Fleet Bank branches, the opening of its first lending office in Portland, the acquisition of a Portland-based brokerage firm, and the creation of an insurance subsidiary.

But perhaps Clif’s most notable achievement was the creation of The Bangor Savings Bank Foundation, significantly advancing the Bank’s philanthropic efforts to help meet the ever-increasing needs of our communities. In honor of his commitment to education and professional development, the Bank built the G. Clifton Eames Learning Center in Bangor.

Clif maintained a keen interest in our work and achievements and was a regular guest at the annual Honorary Trustee luncheon, where he will be missed. We are honored he is part of our legacy.